Document Management

Compliance Solutions

Rules Engine and Loan Auto Decision

Credit Analysis

Automated Policy Exception

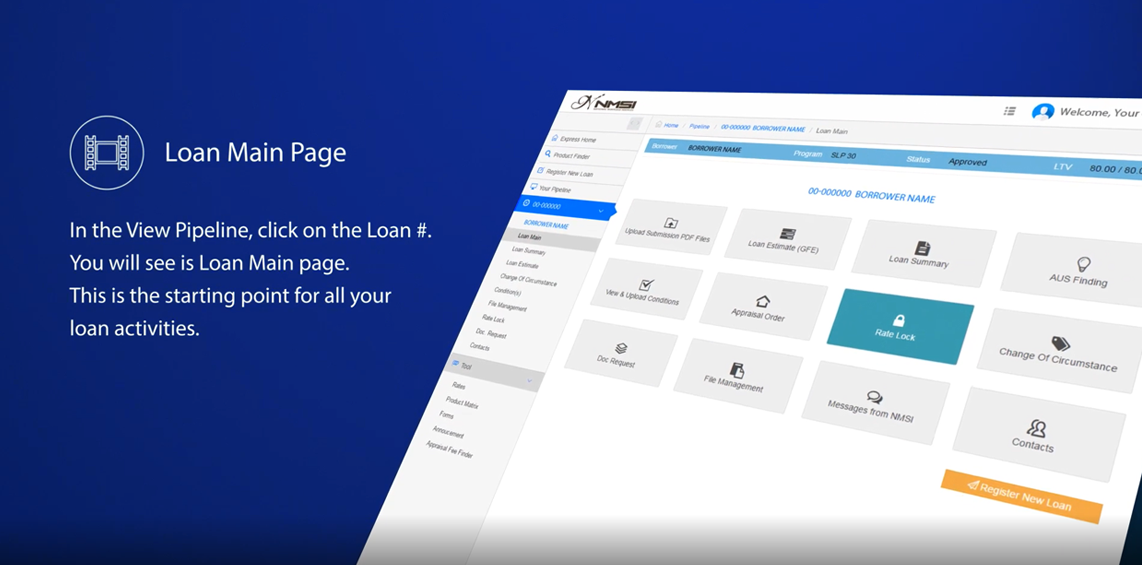

We help organizations seamlessly integrate LOS with other systems and products commonly used in the Mortgage industry. We help simplify your lending process by developing a seamless integration with all your systems to achieve incredible efficiency and automated workflows.