Our AILSA Simple Workflow

AI BLUE helps you work smarter, with intelligent automation and simple workflow.

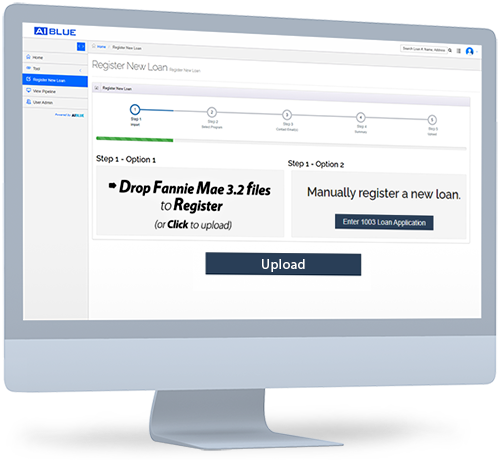

01

Upload FNMA 3.2

You can upload loan-level transactions data for all mortgage loans serviced through the AILSA system features to assist in the data upload process, servicers can utilize the data transfers upload tool.

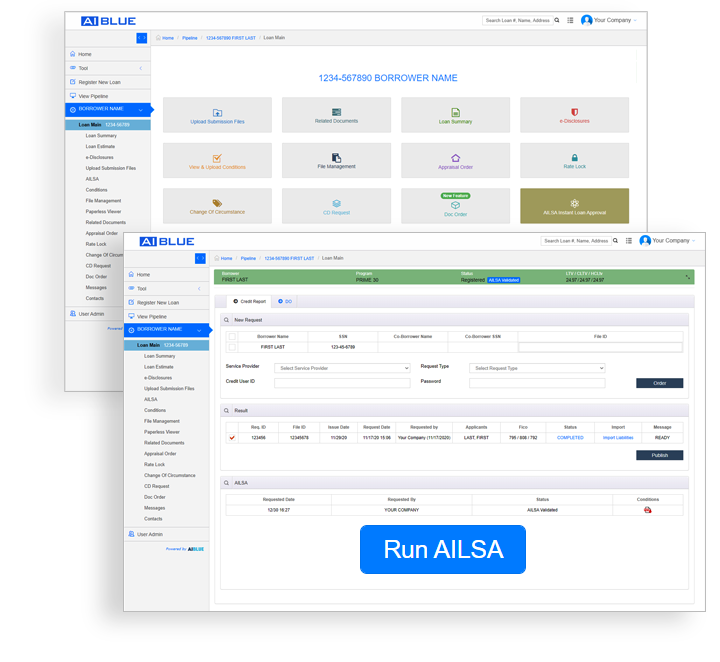

02

Request Credit Report

Ensure that the information on all of your credit reports is correct and up to date.

03

Run AILSA

It give your representative a decision of whether or not their client qualifies for your program with one click of the mouse, or one tap of the screen.

04

Automatically Generates Conditions

Whether it be credit score only, or a mixed bag of credit report factors, your agents will know exactly what credit profile their prospect is.