The Top 3 Functions of

A Mortgage Pricing Engine

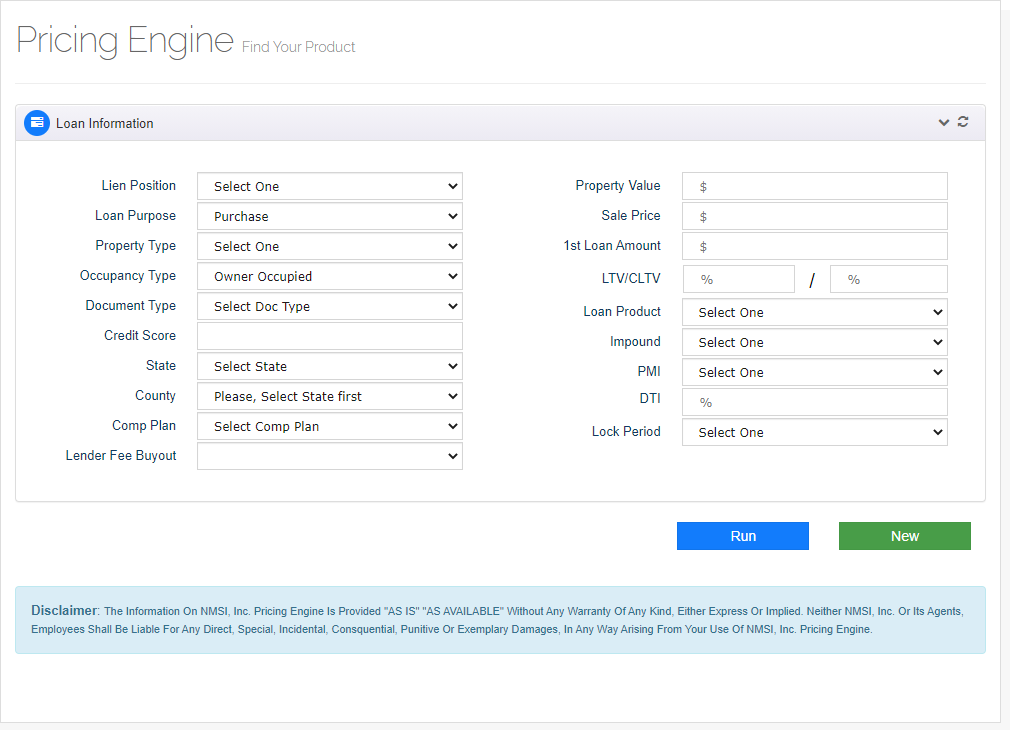

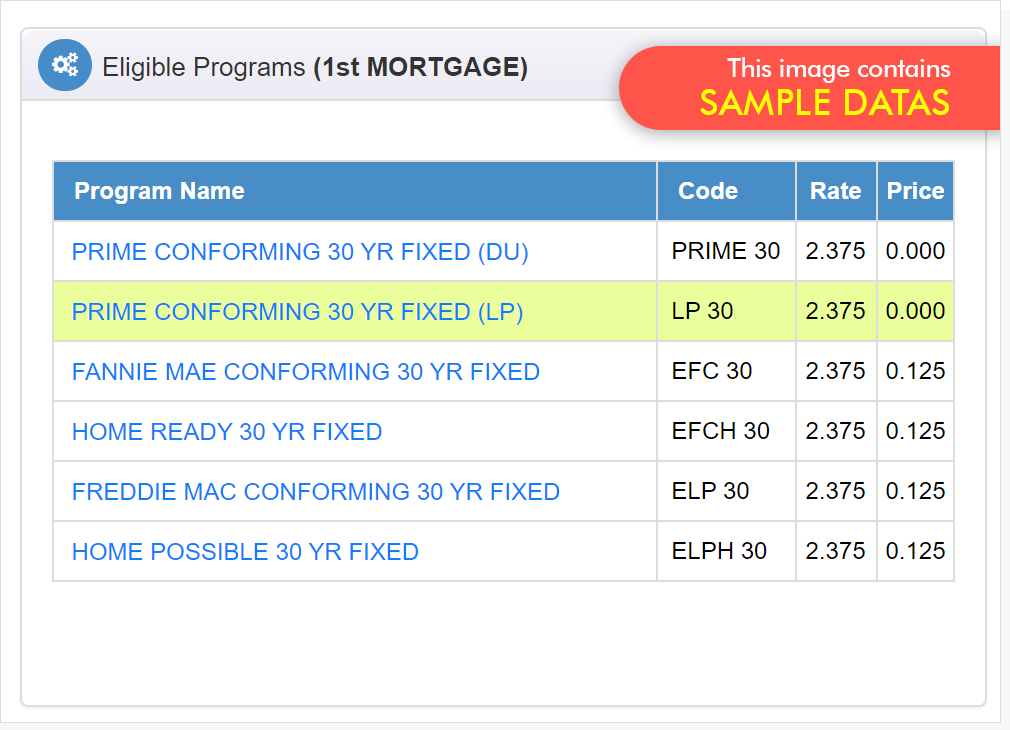

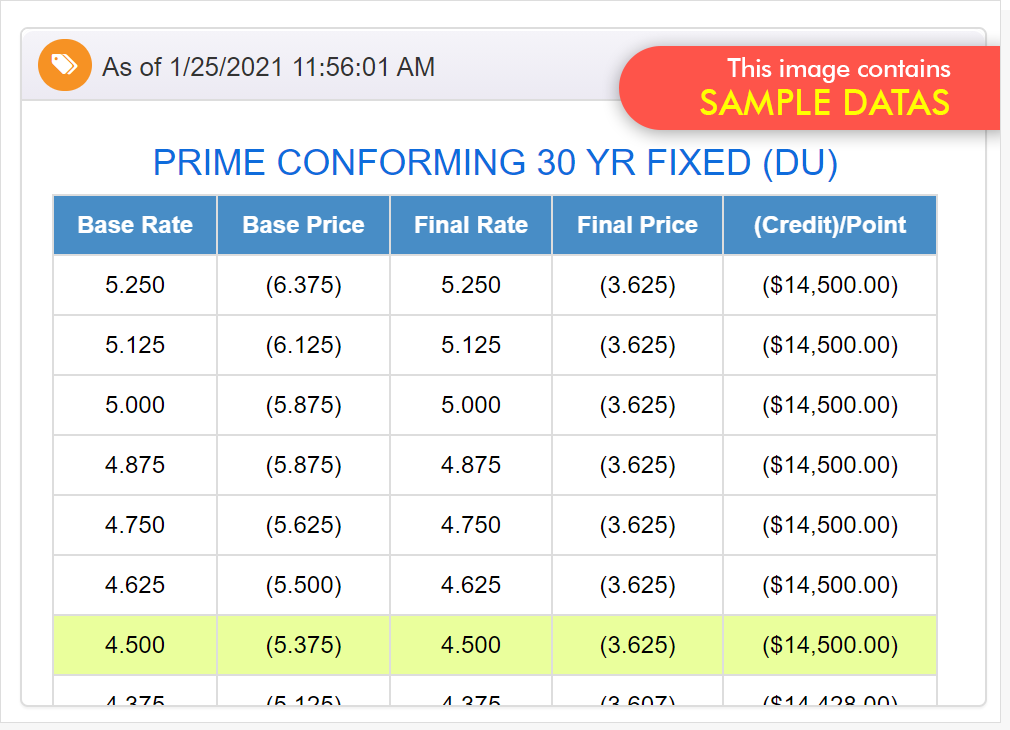

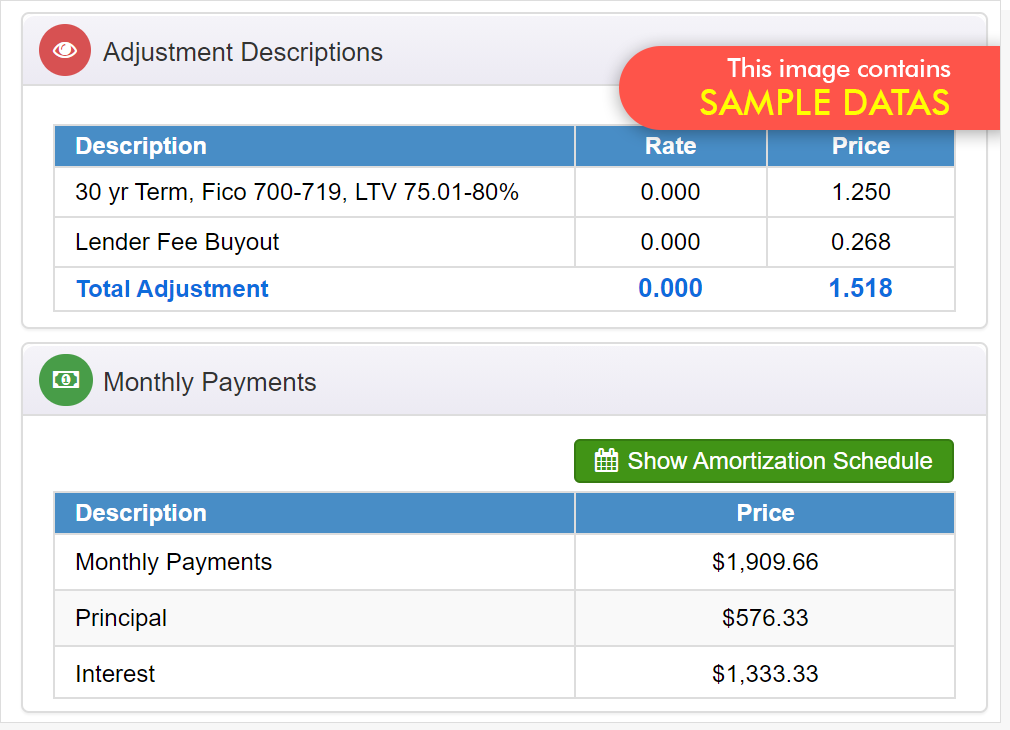

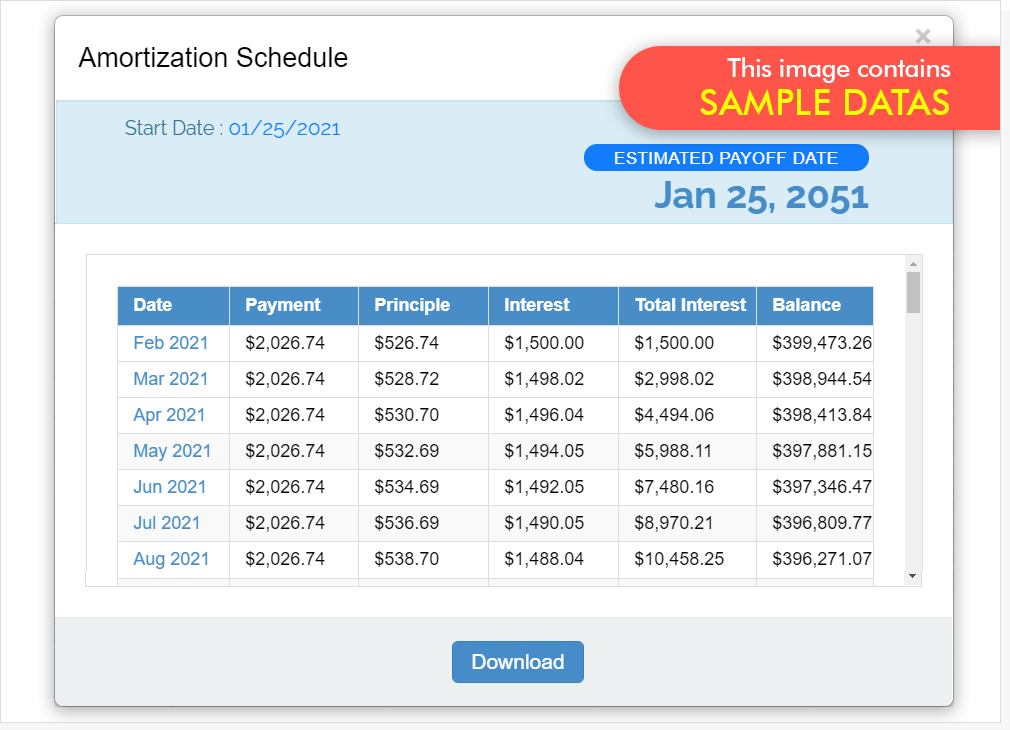

The #1 function of a PPE is its ability to provide accurate, real-time pricing. If you or your company regularly works with specific lenders, you can choose to view their pricing data directly within the PPE. A PPE will help you choose the most profitable lending scenarios for you and your borrowers.

and historical averages

Mortgage pricing engines let you take a look at how your calculated loan scenario compares to worst case scenario projections as well as historical averages.

Another important feature of a mortgage PPE is the ability to lock a borrower’s rate. Normally, rate locks are good for between 30 and 60 days. A rate lock gives a borrower a chance to shop for their home with confidence, knowing that they have a rate locked in.